Investors can buy growth stocks using the same brokerage account as they use to buy stocks and ETFs in other sectors. While buying growth stocks allows investors to begin investing in low-priced stocks set to increase in value, it is not a strategy that comes without risks. Read on to learn the growth stocks definition, what makes a growth stock prepared to rise in value and how you can begin investing in these companies.

What Are Growth Stocks?

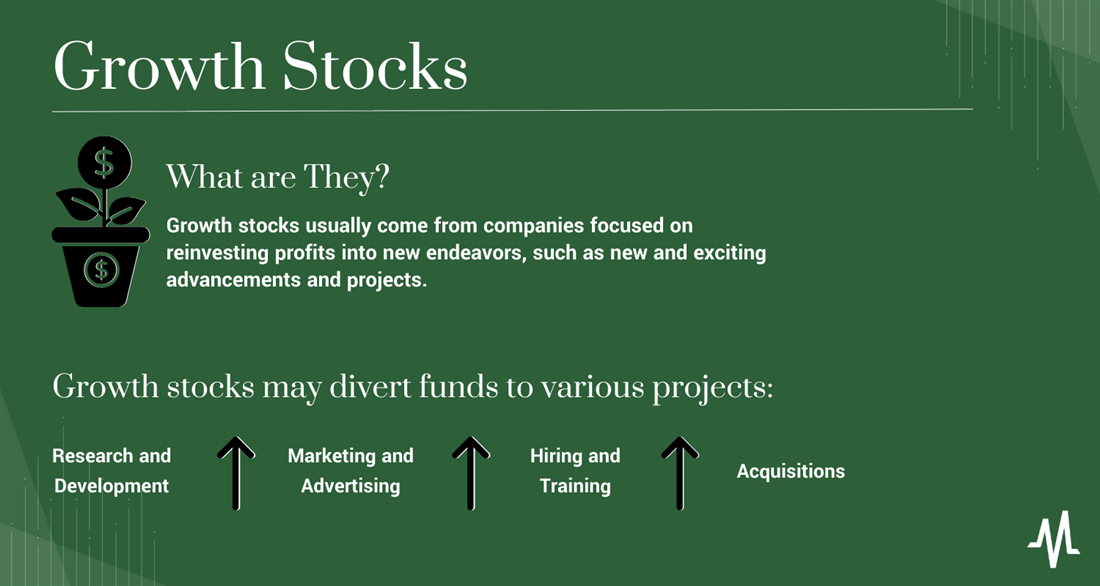

What is a growth stock? Though the growth stock definition you'll hear might vary depending on the investor you're speaking to and the industry you're examining, these stocks usually come from companies focused on reinvesting profits into new endeavors. Instead of distributing a portion of profits to investors through dividends, these companies typically focus on retaining investors through new and exciting advancements and projects.

Growth stocks may divert funds to various projects, including the following:

- Research and development: Growth companies may allocate a significant portion of their profits towards research and development activities to create new products, services or technologies that can help them stay competitive and capture additional market share.

- Marketing and advertising: Companies looking to expand into new markets may also invest in marketing and advertising campaigns to promote their brand and attract new customers.

- Hiring and training: As companies grow and expand, they may need to use a larger portion of their profits to hire and train new employees. Though it may not directly lead to new market share, investing in a robust employee training infrastructure can increase profits through enhanced customer experience.

- Acquisitions: In some cases, growth companies may use profits to acquire other companies to expand their product lines, customer base or geographic reach.

Overall, reinvesting profits back into the company aims to fuel growth and increase shareholder value over the long term. You may have heard the term "value investing," which is different from growth investing.

How to Assess Growth Stocks

Now that we've answered the question of what growth stocks are, you can begin comparing companies you want to add to your portfolio. The following are some major features you'll want to consider before you buy the best growth stocks.

- Revenue growth: One of the key characteristics of growth stocks is that they should grow faster than the overall market. Look for companies that have a track record of strong revenue growth in the past, which may indicate that the company has a reliable plan for future profit increases.

- Earnings growth: In addition to revenue growth, you should also look for companies with a history of strong earnings growth or the potential to generate strong earnings growth in the future. This indicates that the company effectively manages costs and generates healthy profits.

- Market opportunity: Consider the size and growth potential of the company's market when debating which growth stocks have the best chance of providing worthwhile returns. Companies operating in large, growing markets may have more growth opportunities and attractive investment opportunities.

- Competitive advantage: Look for companies with a competitive advantage or a unique value proposition that sets them apart. This could include things like a strong brand, innovative patents or proprietary technology.

- Valuation: Finally, you should consider the valuation of the company's stock relative to its growth prospects. Growth stocks are often priced at a premium, so you should look for companies that are trading at a reasonable valuation given their growth potential. Browse a complete list of professional stock price targets and analyst ratings here to learn about company valuation.

Investing in a growth stocks ETF (for example, the SPDR Portfolio S&P 500 Growth ETF (NYSE: SPYG) can be helpful if you're looking for a quick way to add these expansion-oriented stocks to your portfolio while also diversifying across the market.

How to Find Growth Stocks

When narrowing down your list of potential investments, knowing which industries are best known for growth stocks can be helpful. The following high-growth industries are well-known for their concentration of growth stocks.

- Technology: The technology industry is known for its rapid pace of innovation and disruption. Companies in this industry often have the potential to grow quickly as they develop and market new products and services.

- Healthcare: The healthcare industry should also experience strong growth in the coming years due to factors such as an aging population, increased demand for healthcare services and advances in medical technology.

- E-commerce: With the rise of online shopping and the growth of the digital economy, e-commerce companies should continue multiplying in the future. Spurred by the COVID-19 pandemic, e-commerce levels should stay in demand even as physical stores reopen.

- Renewable energy: With growing concerns about climate change and the shift toward cleaner sources of energy, companies that develop and produce renewable energy technologies may have strong growth potential.

Consider incorporating multiple growth stocks across industries and purchasing many types of stock to diversify across this sometimes risky sector.

How to Invest in Growth Stocks

Most growth stocks trade on major markets, including the New York Stock Exchange and the NASDAQ. If you already have a brokerage account, you can use your existing account to research and buy shares of stock using the same method as any other investment. If you're unfamiliar with investing, read on for a complete beginner's guide to buying stock.

Step 1: Open a brokerage account.

A brokerage account is a type of investment account that allows you to buy and sell securities, such as stocks, bonds, mutual funds and ETFs. If you don't already have a brokerage account, you'll need to research major brokers and open an online account before you can begin buying and selling shares of stock. Learn more about major brokerage options and what you'll need to open an account.

Step 2: Research stock options.

After opening and funding your account, decide which investments you'd like to add to your portfolio. You can use your broker's stock screening tools to filter for stocks with high growth metrics, including revenue growth, earnings growth and other key performance indicators that may signal strong future growth potential.

Step 3: Place a buy order.

After identifying a stock or ETF you want to add to your portfolio, place a buy order through your brokerage account. While most brokers offer a wide range of order types, the two most common orders you'll use to buy and sell growth stocks are market orders and limit orders.

- Market orders: A market order is a type of order in which you buy or sell a security at the best available price on the market when you place the order. You should use this type of order when the speed of execution is more important than the price at which the trade goes through and when there is high liquidity in the market.

- Limit orders: A limit order is a type of order in which you buy or sell a security at or below a specified price. Limit orders can help you avoid buying or selling a security at a less favorable price than what you are willing to accept. However, there is no guarantee that your brokerage will execute the limit order if the market price does not reach your specified price.

After placing your order, your broker will execute it according to your terms. If the broker can execute the order, you'll see your shares in your brokerage account.

Step 4: Monitor your investment.

After buying your shares, monitor your investments and how they change in value. If you're using a short-term trading strategy, consider placing a stop-loss order to limit your losses if your investment sharply drops in value.

Pros and Cons of Investing in Growth Stocks

Consider both the benefits and drawbacks of investing in growth stocks before adding them to your portfolio.

Pros

Let's look at the benefits of growth stocks first:

- Potential for high returns: Growth stocks are typically companies with strong earnings growth potential, which can lead to significant capital appreciation if the company meets or exceeds growth expectations.

- Innovation and disruption: Growth companies are often at the forefront of innovation and disruption, leading to transformative changes in the industry and significant returns on your initial investment if you get in early.

- Diversification: Investing in growth stocks can help diversify your portfolio by providing exposure to riskier assets. These assets can enhance returns on a stable portfolio of consumer staples when the market is bullish.

Cons

Now, the downsides to growth stocks:

- Higher risk: Growth stocks are often riskier than value stocks, as they may be more volatile and subject to market fluctuations.

- Uncertainty: The future growth potential of a company may be uncertain, and you may not see all growth expectations met. Both of these situations may lead to significant declines in stock price.

- Fewer dividends: Growth stocks tend to reinvest profits into operations, leaving less for dividend distributions, which can force investors to wait longer to see a return on their initial capital.

Consider Investing in Growth Stocks

What are growth stocks, exactly? Growth stocks are shares of companies focused on expanding into new markets, product lines or otherwise enhancing operations. However, as the company grows, the stock may not remain growth-oriented forever. Review company financials regularly after investing in these types of assets to be sure that your current portfolio makeup meets your goals as they change.

Learn more about how to calculate stock growth.

FAQs

Still wondering what to know about growth stocks? The following are some of new investors' most common questions about growth stocks.

Is it good to invest in growth stocks?

Growth stocks can provide high returns due to their expected faster growth. However, growth stocks can also be riskier investments because they tend to reinvest their profits back into company growth rather than providing dividends to shareholders. This can mean waiting longer for returns, which are never guaranteed.

What are the best growth stocks to invest in?

The best stocks to add to your portfolio will vary depending on your unique investing goals and timeline. Some of the largest growth stocks on the market as of March 2023 include Alphabet, Amazon.com and Tesla.

Are growth stocks risky?

Yes, growth stocks may be risky because they are sometimes associated with companies with high growth potential and high uncertainty and volatility levels. They may be in the early stages of development, with limited opportunities for investors to review financial and management history. If you decide to learn how to invest in growth stocks, be sure that these assets make up only a small percentage of your overall portfolio.